Purchasing a trailer is an important investment, one that can impact your daily operations, cash flow, and long-term growth. While paying cash may seem like the simplest option, financing is often the smarter choice for many businesses.

At Air-tow Trailers, we offer financing options designed to help customers get the equipment they need without putting unnecessary strain on their finances. Here’s when financing a trailer makes sense and why it may be the right move for your business.

1. When You Want to Preserve Cash Flow

Cash is critical for day-to-day operations. Payroll, fuel, insurance, maintenance, and unexpected expenses all add up quickly.

Financing allows you to:

- Keep cash available for operating expenses

- Avoid draining reserves with a large upfront purchase

- Spread the cost of a trailer over manageable monthly payments

Instead of tying up capital in a single purchase, financing helps keep your business flexible and financially healthy.

2. When the Trailer Will Generate Revenue

If your trailer will be used to:

- Complete more jobs

- Transport equipment more efficiently

- Reduce labor costs

- Expand services or rental offerings

…then financing often pays for itself.

Many customers find that the revenue or savings generated by their trailer exceeds the monthly payment, making financing a strategic investment rather than a cost.

3. When You Want to Upgrade or Expand Sooner

Waiting to save for a trailer can mean:

- Missed opportunities

- Delayed growth

- Continued inefficiencies

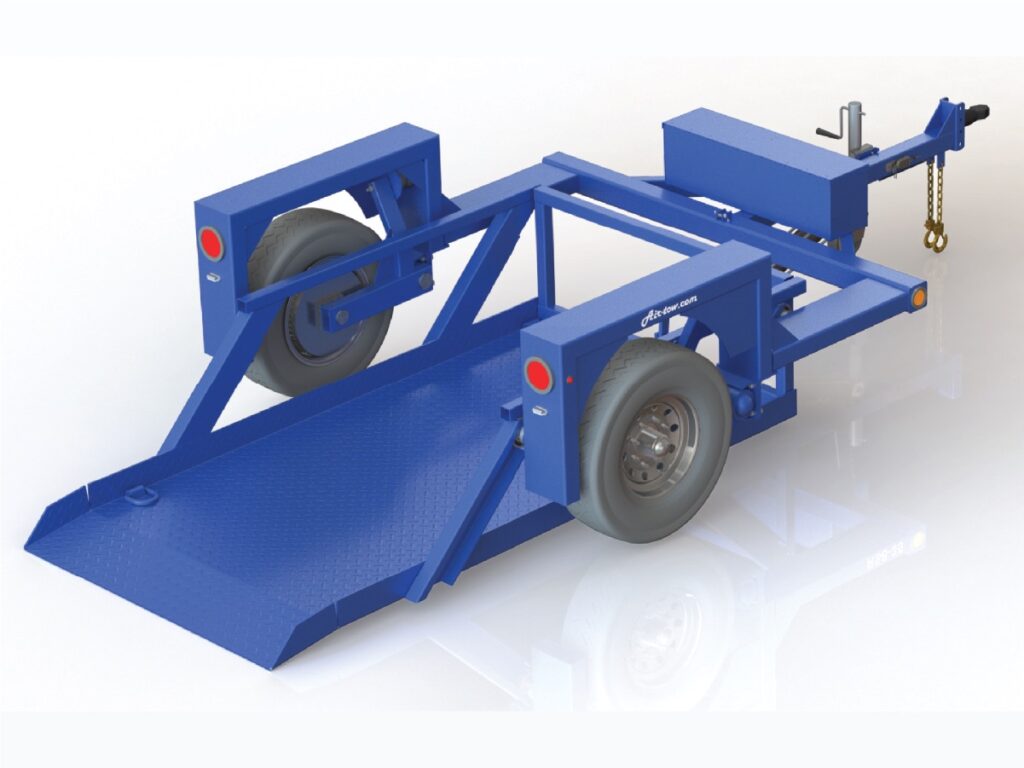

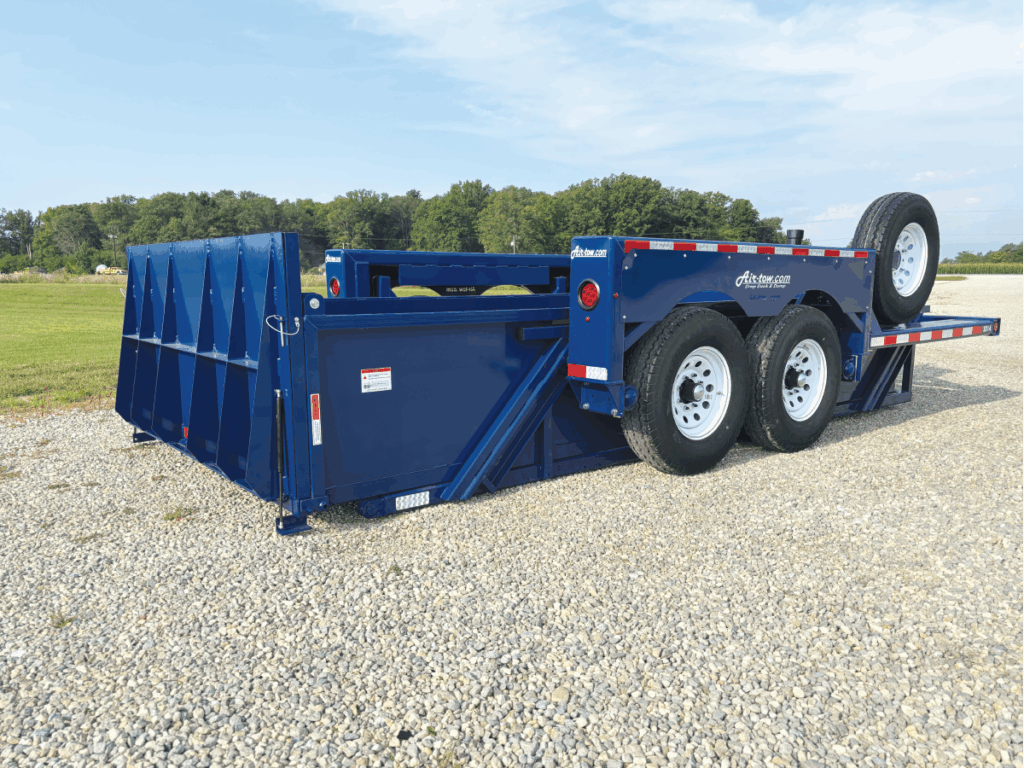

Financing allows you to put the right equipment to work now, not later. Whether you’re adding to your fleet or upgrading to ground-level loading technology, financing helps you move forward without delay.

4. When You Want Predictable Monthly Costs

Financing provides:

- Fixed, predictable payments

- Easier budgeting and forecasting

- Fewer surprises compared to large one-time purchases

This consistency is especially valuable for small businesses, contractors, and rental fleets that rely on steady cash flow.

5. When the Trailer Is a Long-Term Asset

Air-tow Trailers are built for durability, reliability, and long service life. Financing a trailer that will serve your business for years often makes sense because:

- The trailer remains productive long after it’s paid off

- Monthly payments align with the trailer’s usable lifespan

- You benefit from the equipment while spreading out the cost

Financing Options Available at Air-tow Trailers

Air-tow Trailers offers financing options to make trailer ownership easier and more accessible. Our streamlined process allows many customers to receive quick approval and get their trailer to work sooner.

Financing may be available with little to no money down, helping preserve cash for daily operations. Monthly payments are predictable, making budgeting simple, and you can explore options with a soft credit check that won’t impact your credit score.

Whether you’re purchasing a single trailer or expanding your fleet, our team can help you find financing that fits your business.

Apply now: https://airtow.com/trailer-financing/

Is Financing Right for You?

Financing isn’t about stretching your budget; it’s about using your capital wisely. If you want to protect cash flow, grow your business, or put equipment to work immediately, financing an Air-tow trailer may be the smart choice.

📞 Contact Air-tow Trailers today to learn more about our financing options and find the right trailer for your operation.